Q.1 Attempt all of the following sub-questions:

(A) Select the correct options and rewrite the statements

(1) To find out the net profit or net loss of the business _____________Account is prepared.

(a) Trading (b) Capital

(c) Current (d) Profit and Loss

(2) From financial statement analysis the creditors are specially interested to know____________

(a) Liquidity (b) Profits

(c) Sale (d) Share Capital

(3) Death is a compulsory _____________

(a) dissolution (b) admission

(c) retirement (d) winding up

(4) The due date of the bill drawn for 2 months on 23rd November, 2019 will be _____________

(a) 23rd Jan, 2020 (b) 25th Jan, 2019

(c) 26th Jan, 2019 (d) 25th Jan, 2020

(5) Decrease in the value of assets should be_________________to Profit and Loss Adjustment Account.

(a) debited (b) credited

(c) added (d) none of the above

(B) Write a word / term / phrase as a substitute for each of the following statements:

(1) Debit balance of Trading Account. Gross Loss

(2) Expenses incurred on dissolution of firm. Dissolution/realisation Expenses

(3) Old Ratio less New Ratio. Sacrifice Ratio

(4) Officer appointed by Govt. for noting of dishonour of bill. Notary Public

(5) Donation received for a specific purpose. Specific donation / Capital receipt

(C) Answer the following questions in only ‘one’ sentence each:

(1) What is Legacy?

Ans. Any assets, property or amount of cash that the ‘Not for Profit’ concern receives per the provision made in the donor’s will after his death is called a Legacy

(2) What is CAS?

Ans. CAS means Computerized Accounting System which help business firms to implement accounting process and makes it user friendly with automation

(3) Who is called Insolvent Person?

Ans. When a person is unable to contribute fully or partially to discharge his/her liabilities out of his/her private assets, then that person is regarded as an insolvent. Thus, in the following two situations, a partner is declared as insolvent:

a. When his/her personal assets are insufficient

b. When his/her debit capit balance cannot be covered

(4) What is Reserve Capital?

Ans. Reserve capital represents the portion of subscribed capital that remains uncalled except in case of winding up or at the time of liquidation. As per Section 99 of the Companies Act, 1956, a company can create reserve capital by passing a special resolution.

(5) What is Revaluation Account?

Ans. Revaluation Account is an account that is opened at the time of admission, retirement and death of a partner. This account records the effect of every increase or decrease in the value of assets and liabilities. The balance of this account (which may be either profit or loss) is transferred to the Old Partners’ Capital Accounts, as the new partner has no right over such profits earned ior to his/her admission.

(d) Complete the sentences:

(1) Partnership deed is an Article of partnership.

(2) Aurangabad University prepares Income From Expenditure Account instead of Profit and Loss Account

(3) Returns outward are deducted from Purchases

(4) New Ratio (–) Old ratio= Gain Ratio.

(5) Cash receipts which are recurring in nature are called as Revenue receipts.

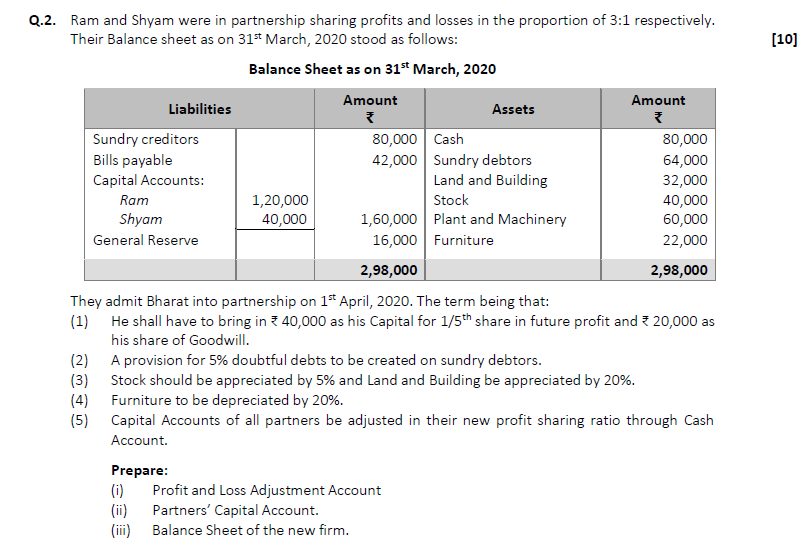

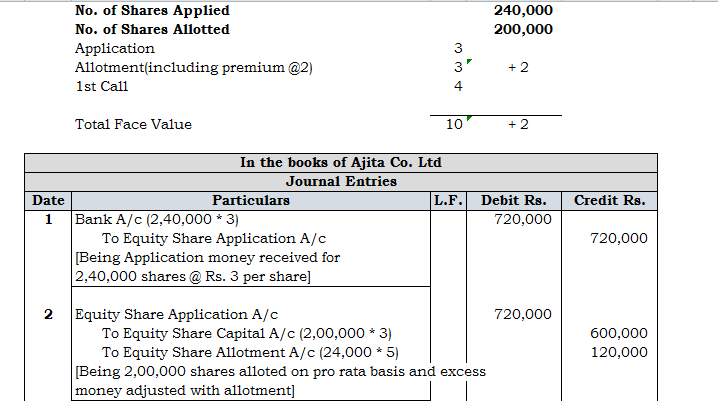

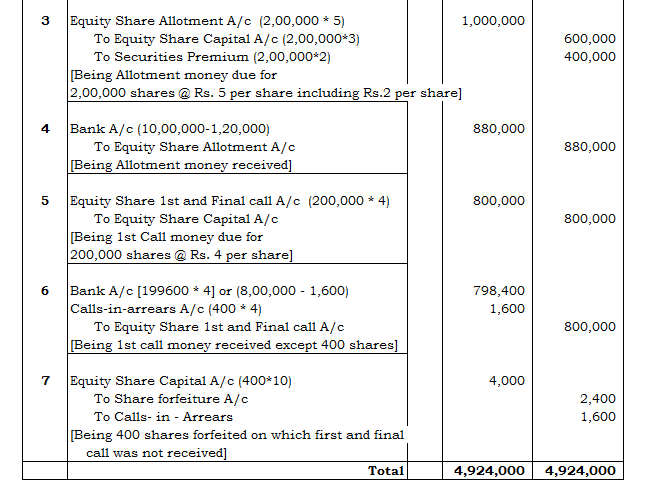

Q.2 A

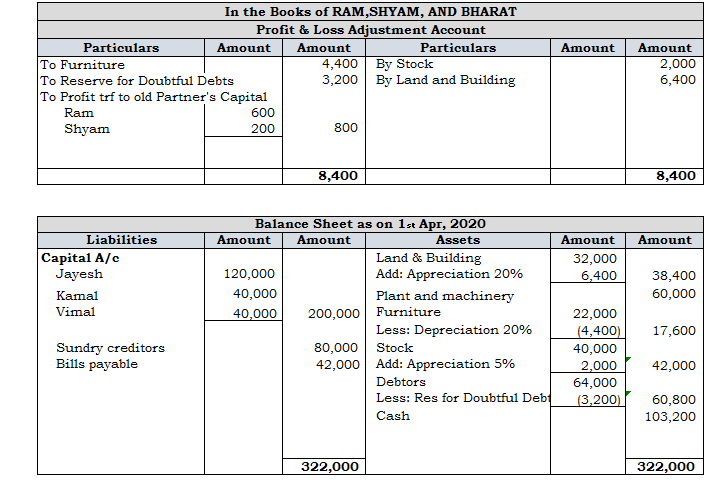

SOLUTION

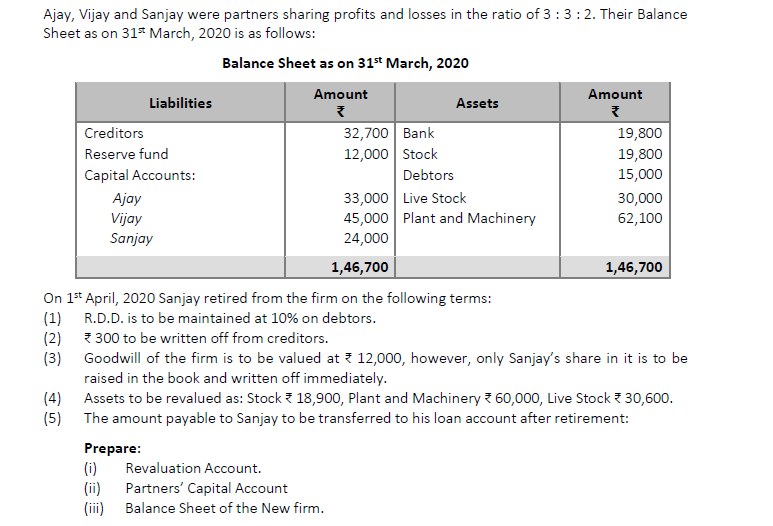

Q.2 B

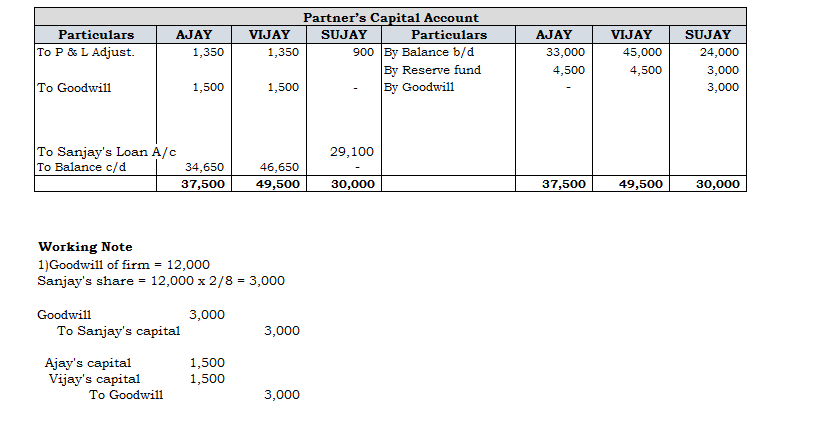

SOLUTION

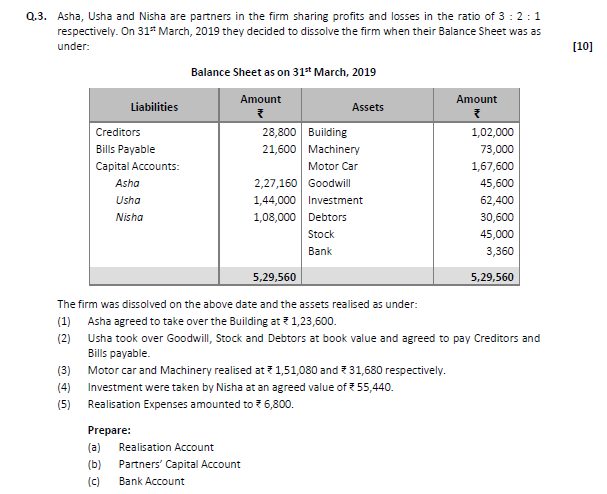

Q.3 A

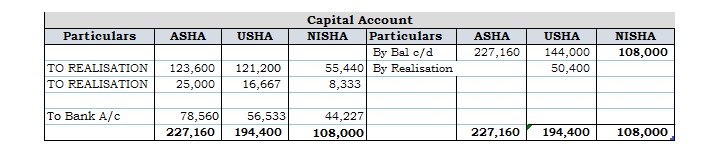

SOLUTION

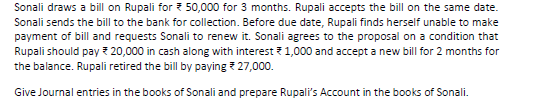

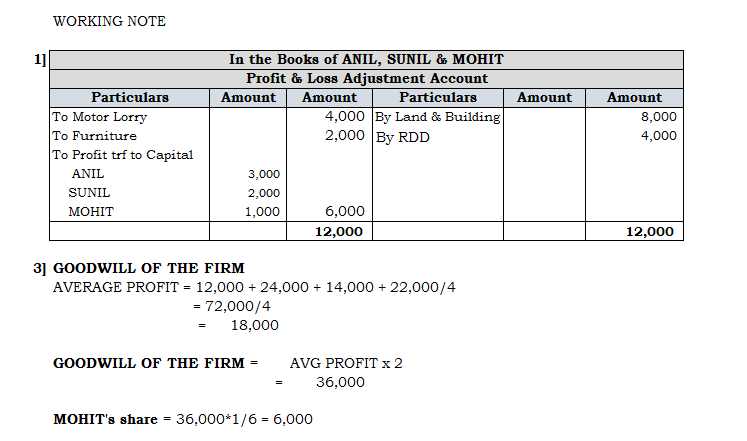

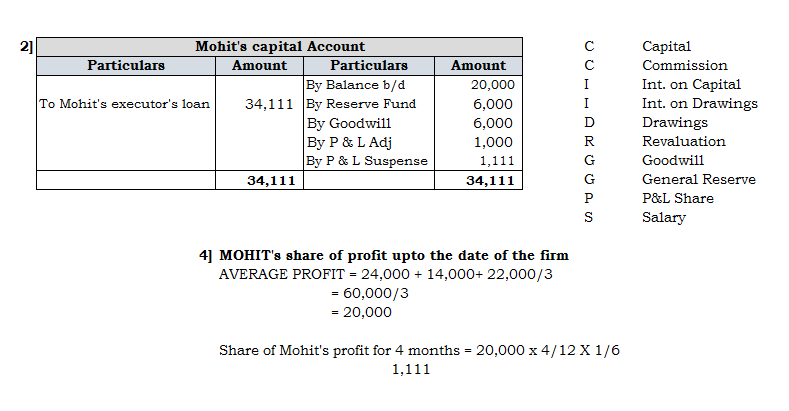

Q.3 B

SOLUTION

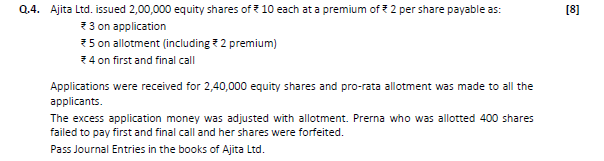

Q.4

SOLUTION

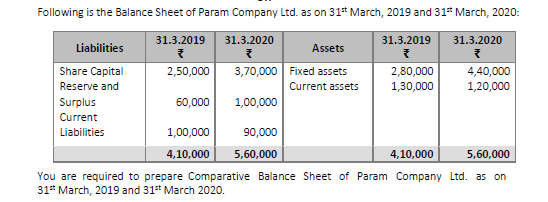

Q.5 A

SOLUTION

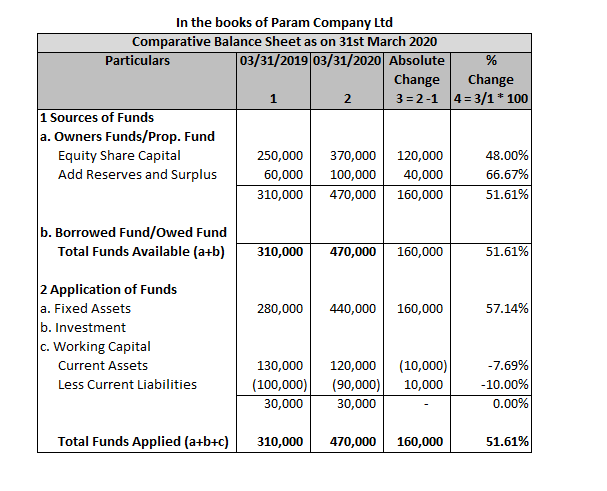

Q.5 B

SOLUTION

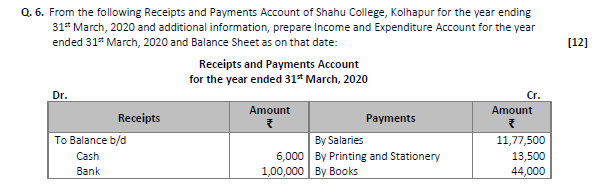

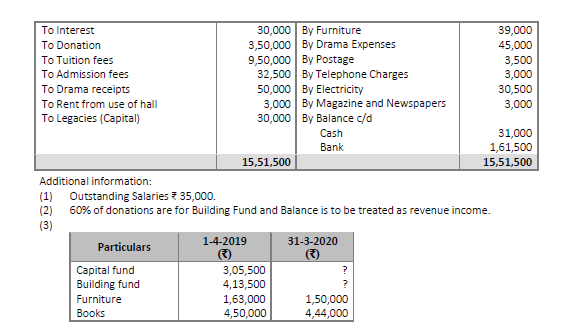

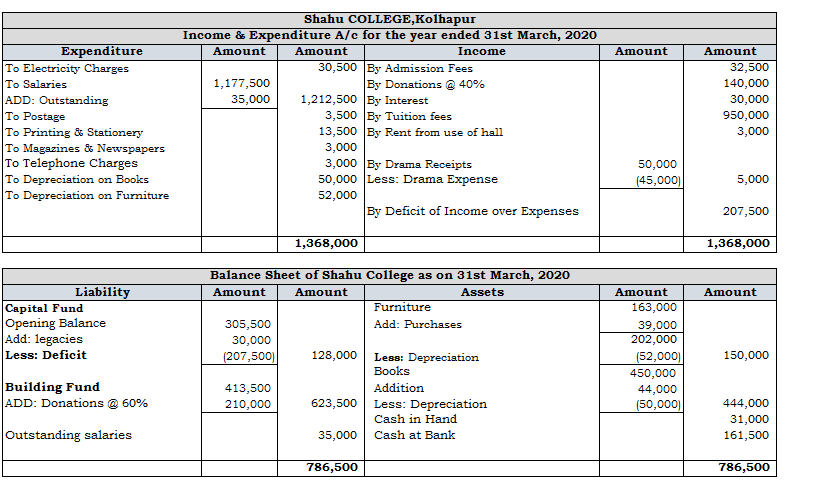

Q.6

SOLUTION

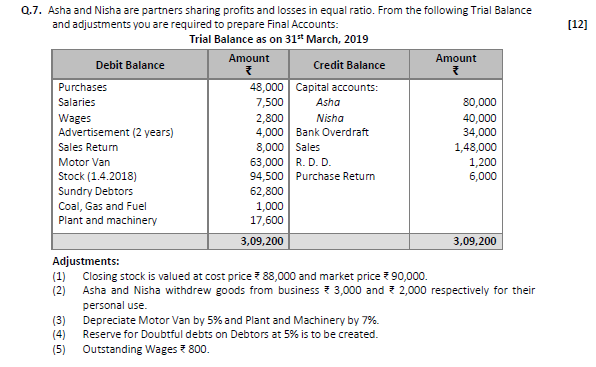

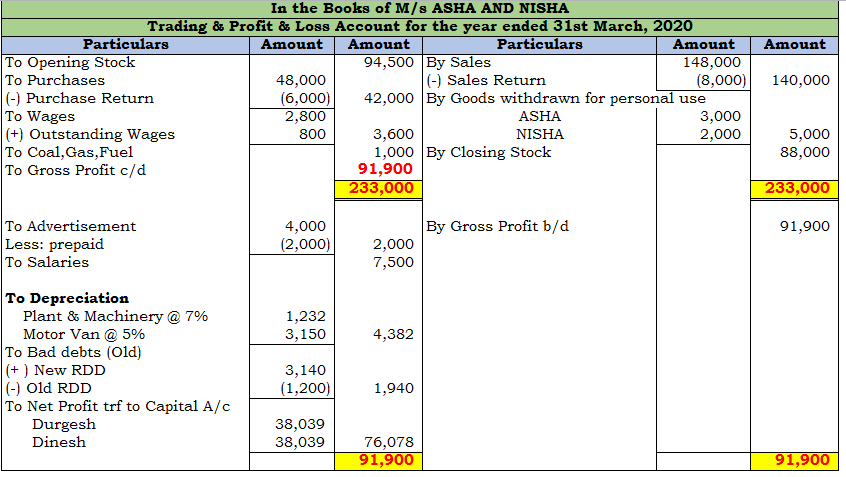

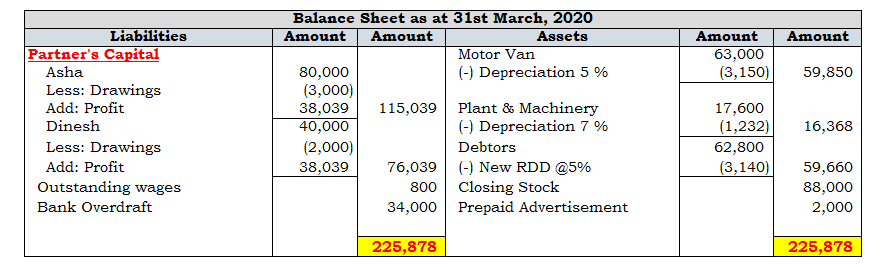

Q.7

SOLUTION

mexican mail order pharmacies: cmq pharma mexican pharmacy – pharmacies in mexico that ship to usa

You have mentioned very interesting points!

ps nice web site.Leadership

online canadian drugstore: canadian pharmacy 24h com safe – canadian medications

http://indiapharmast.com/# online shopping pharmacy india

mexican rx online: mexican pharmaceuticals online – buying prescription drugs in mexico online

indianpharmacy com Online medicine home delivery india pharmacy

mexico pharmacies prescription drugs: mexican rx online – pharmacies in mexico that ship to usa

canadian pharmacy near me canadian pharmacy no scripts canadian pharmacy ltd

mexico drug stores pharmacies: medication from mexico pharmacy – mexico pharmacies prescription drugs

https://indiapharmast.com/# pharmacy website india

best india pharmacy: Online medicine home delivery – Online medicine order

canadian pharmacy king reviews best canadian online pharmacy reviews canadianpharmacy com

Online medicine order: best india pharmacy – Online medicine order

purple pharmacy mexico price list: mexico drug stores pharmacies – mexican pharmacy

http://foruspharma.com/# mexico pharmacies prescription drugs

canadian pharmacy meds: canadian pharmacies – legit canadian pharmacy online

legitimate canadian pharmacy online: www canadianonlinepharmacy – canadian compounding pharmacy

п»їbest mexican online pharmacies pharmacies in mexico that ship to usa mexican rx online

canadian pharmacies online: canada drug pharmacy – canadian king pharmacy

https://canadapharmast.com/# online canadian pharmacy

purple pharmacy mexico price list buying prescription drugs in mexico mexico pharmacy

Online medicine order: top online pharmacy india – indian pharmacies safe

cost cheap clomid price: cost of clomid without a prescription – where to buy clomid no prescription

https://amoxildelivery.pro/# amoxicillin without a prescription

doxycycline 75 mg capsules: doxycycline online australia – cost doxycycline tablets

http://paxloviddelivery.pro/# paxlovid covid

how can i get clomid tablets: how can i get clomid no prescription – cost of cheap clomid

http://amoxildelivery.pro/# amoxicillin generic brand

where can i get amoxicillin 500 mg amoxicillin 500mg capsules antibiotic amoxicillin order online

https://amoxildelivery.pro/# amoxicillin 875 mg tablet

buy ciprofloxacin over the counter ciprofloxacin order online purchase cipro

http://ciprodelivery.pro/# п»їcipro generic

buy generic clomid without rx: where to get cheap clomid price – clomid otc

http://clomiddelivery.pro/# how to get cheap clomid without rx

https://doxycyclinedelivery.pro/# where to get doxycycline

http://clomiddelivery.pro/# clomid rx

paxlovid pharmacy paxlovid generic paxlovid cost without insurance

where can i buy cheap clomid without insurance: cost generic clomid pills – can i buy clomid without rx

https://ciprodelivery.pro/# cipro pharmacy

https://amoxildelivery.pro/# where can i buy amoxicillin without prec

http://doxycyclinedelivery.pro/# doxycycline 100mg without prescription

cost of doxycycline 40 mg doxycycline capsules generic for doxycycline

amoxicillin 500 mg tablet price: can you buy amoxicillin over the counter – medicine amoxicillin 500mg

https://paxloviddelivery.pro/# buy paxlovid online

http://doxycyclinedelivery.pro/# doxy 200

https://ciprodelivery.pro/# buy cipro online without prescription

cost of generic clomid without dr prescription order clomid without dr prescription how to buy clomid without prescription

ciprofloxacin order online: cipro 500mg best prices – buy cipro online without prescription

https://ciprodelivery.pro/# ciprofloxacin order online

http://paxloviddelivery.pro/# paxlovid price

http://amoxildelivery.pro/# amoxicillin 250 mg capsule

ciprofloxacin 500 mg tablet price ciprofloxacin 500mg buy online ciprofloxacin

https://doxycyclinedelivery.pro/# buy doxycycline over the counter uk

where to buy generic clomid pills: where to get clomid price – how to buy cheap clomid without prescription

https://ciprodelivery.pro/# cipro 500mg best prices

http://amoxildelivery.pro/# where can i buy amoxicillin over the counter uk

http://amoxildelivery.pro/# amoxicillin 750 mg price

purchase cipro ciprofloxacin order online ciprofloxacin 500mg buy online

amoxicillin without a prescription: amoxicillin cephalexin – order amoxicillin uk

http://ciprodelivery.pro/# antibiotics cipro

http://amoxildelivery.pro/# amoxicillin from canada

https://amoxildelivery.pro/# amoxicillin in india

can you buy clomid without dr prescription can i order generic clomid without insurance order generic clomid without insurance

doxycycline pills online: doxycycline australia – doxycycline 20 mg

https://amoxildelivery.pro/# buy amoxicillin 500mg uk

ciprofloxacin generic: ciprofloxacin order online – ciprofloxacin 500mg buy online