Q 1. All objective questions are compulsory

(A) Write the word/phrase/term which can substitute each of the following

statements:

(1) Credit balance of profit and loss account Net Profit

(2) Donation received for a specific purpose Specific donation/ Capital Receipt

(3) The ratio which is obtained after deducting old ratio from new ratio Gain Ratio

(4) Expenses incurred on dissolution of firm. Dissolution/realisation Expenses

(5) Tally software is classified into this category Eercantile

B) Calculate the following:

(1) Calculate 12.5% p.a. depreciation on furniture

(a) On 2,20,000 for 1 year (b) On 10,000 for 6 month

SOLUTION

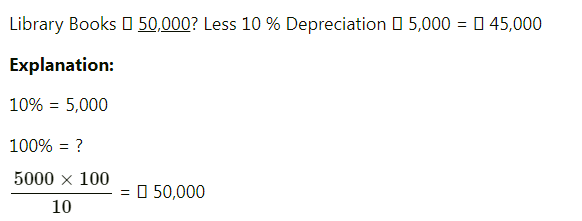

(2) Library books _________ Less 10% Depreciation 5,000 = ` 45,000

SOLUTION

(3) Apte and Bhate are sharing profits and losses in the ratio 3:2, if Kate is admitted at ¼ share then calculate new profit sharing ratio

SOLUTION

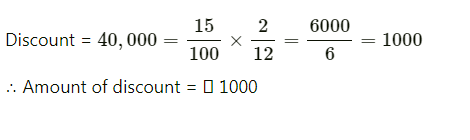

(4) Ganesh draws a bill for ` 40,000 on 15th January, 2020 for 2 months. He discounted the bill with bank of India @ 15% p.a. on the same day. Calculate the amount of discount.

SOLUTION

(5) From the following information, calculate Current Assets :

Debtors 60,000, Creditors 30,000, Bills Payable 20,000, Stock 30,000,

Loose tools 10,000, Bank Overdraft 10,000

SOLUTION

(C) Do you AGREE/DISAGREE with the following statements :

(1) Partnership is an association of two or more persons AGREE

(2) Not for profit concerns do not prepare Balance Sheet DISAGREE

(3) Retiring partner is not entitled to share in general reserve and accumulated profit DISAGREE

(4) Dissolution takes place when the relation among the partners comes to an end AGREE

(5) The Authorized Capital is also known as Nominal Capital AGREE

(D) Select the most appropriate alternative from those given below and rewrite the statements :

(1) Maximum numbers of partners in firm are _______ according to Companies Act 2013

(a) 10 (b) 25 (c) 20 (d) 50

(2) Income and expenditure account is a _______ account

(a) Capital (b) Real (c) Personal (d) Nominal

(3) If asset is taken over by the partner____________ account is debited

(a) Revaluation (b) Capital (b) Asset (d) Balance Sheet

(4) Death is compulsory ___________

(a) dissolution (b) admission (c) retirement (d) winding up

(5)The person on whom a bill is drawn is called a ____________

(a) drawee (b) payee (c) drawer (d) acceptor

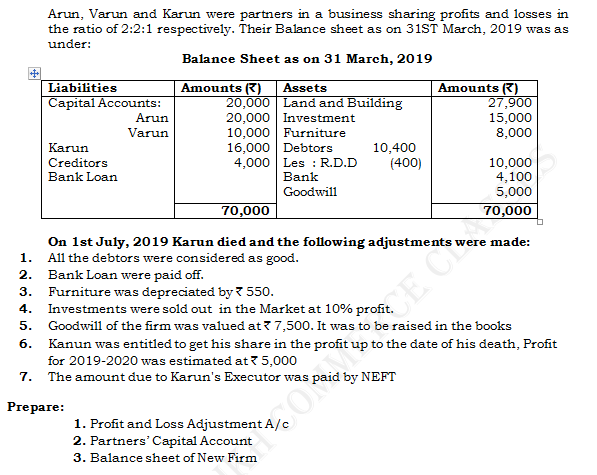

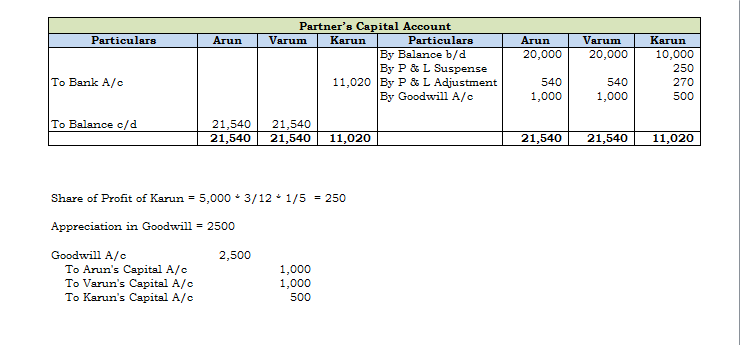

Q.2 A

SOLUTION

Q.2 B

SOLUTION

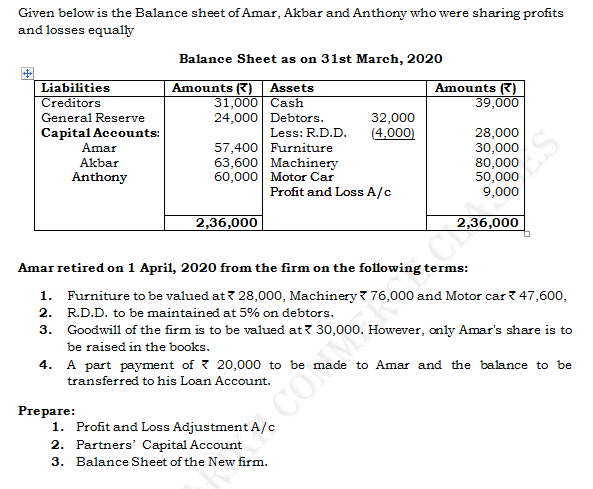

Q.3 A

SOLUTION

Q.3 B

SOLUTION

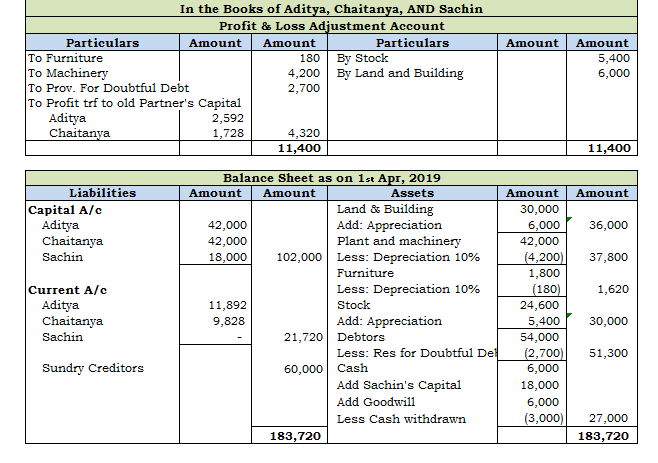

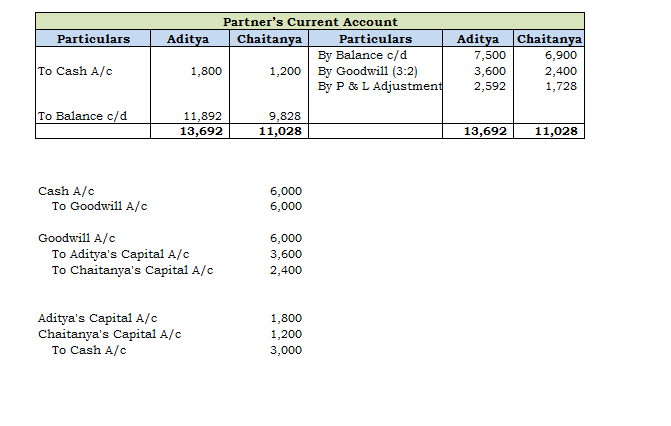

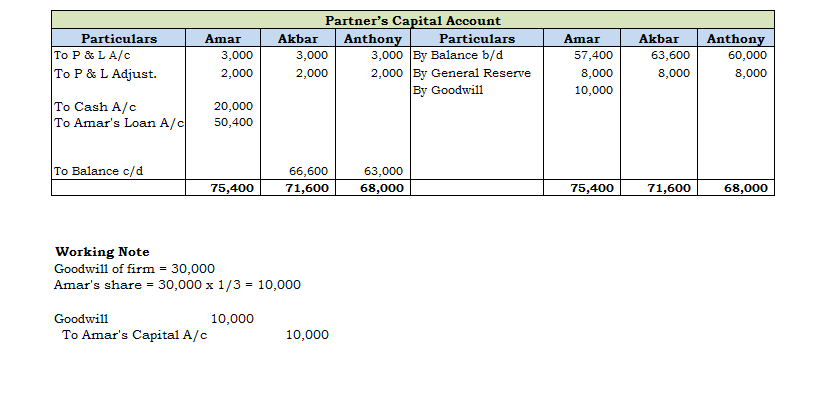

Q.4

SOLUTION

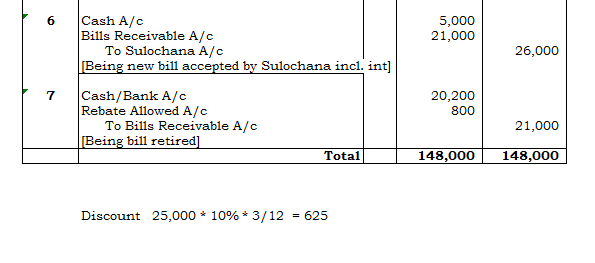

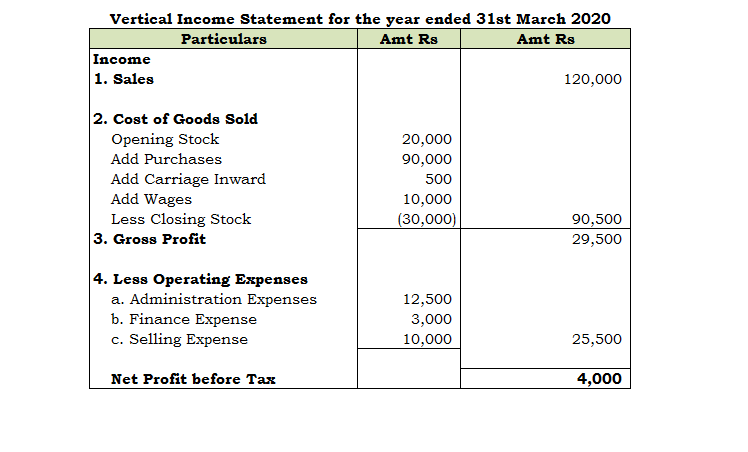

Q.5 A

SOLUTION

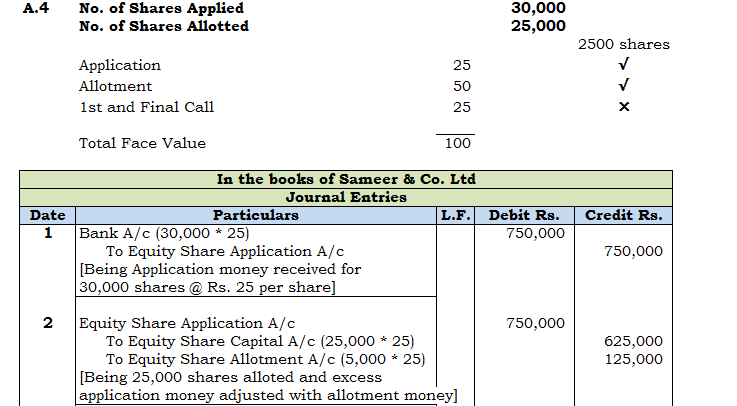

Q.5 B

SOLUTION

Q.7

SOLUTION

mexican pharmacy: mexican pharmacy online – mexican pharmacy

mexican mail order pharmacies

https://cmqpharma.com/# mexican pharmaceuticals online

best online pharmacies in mexico

I was looking through some of your blog posts on this site and I believe this internet site is rattling instructive!

Keep on posting.Blog money

HSC Commerce Class 12 Maharashtra Accounts March 2023 Paper Solution – Commerce Learning

[url=http://www.gg40z98d59n80z5dfq9us26sz07si9m0s.org/]ufrocmsbj[/url]

frocmsbj http://www.gg40z98d59n80z5dfq9us26sz07si9m0s.org/

afrocmsbj

buy prescription drugs from india: indianpharmacy com – buy prescription drugs from india

https://canadapharmast.com/# canadian pharmacy 24h com

purple pharmacy mexico price list buying prescription drugs in mexico mexico drug stores pharmacies

canadian pharmacy 24h com my canadian pharmacy review onlinecanadianpharmacy

http://foruspharma.com/# mexican border pharmacies shipping to usa

pharmacies in mexico that ship to usa: medication from mexico pharmacy – mexico pharmacies prescription drugs

northwest canadian pharmacy: canadian pharmacy store – canadian pharmacy reviews

http://indiapharmast.com/# top online pharmacy india

77 canadian pharmacy canadian pharmacy 24 com canadian pharmacy in canada

mexico drug stores pharmacies mexican online pharmacies prescription drugs mexican pharmacy

canadian pharmacy checker: best rated canadian pharmacy – buying from canadian pharmacies

mexico pharmacy: mexican pharmaceuticals online – best online pharmacies in mexico

http://foruspharma.com/# medication from mexico pharmacy

Trendy Multicolor Letter Print Hoodie – Cozy Cotton Unisex Pullover with Statement Design Everyday Fashionable Hoodie

Canning Line Equipment

Extra Large Electric Lifting Beauty Pet Grooming Table

Hydraulic Lifting Grooming Table with Cabinet

Round Pneumatic Lifting Pet Grooming Table

yumemiya.co.jp

Square Pneumatic Lift Pet Grooming Table

Women Long Loose Drop Shoulder Lavender Oversized Cotton T-Shirt For Women With Side Pockets And Embroidered Logo

Automatic Can Seamer Machine

Industrial Canning Equipment

Automatic can making machine

Men White Basic T-Shirt

Productive Can Machines

Spring And Summer Solid Color Blank Top Women Gym Fitness Tees Cropped Plain T Shirt For Ladies

Elegant Mint Green Tie-Waist Tunic Top for Women Chic Flowy Summer Blouse

Ultra-Light Aluminum Competition Grooming Table

mexico drug stores pharmacies: buying from online mexican pharmacy – mexico pharmacy

trusted canadian pharmacy canadian pharmacy world my canadian pharmacy rx

indian pharmacy: reputable indian pharmacies – india online pharmacy

https://canadapharmast.com/# legitimate canadian mail order pharmacy

trusted canadian pharmacy canadian mail order pharmacy real canadian pharmacy

canadapharmacyonline com: canadian online drugstore – canadianpharmacyworld com

buy medicines online in india: world pharmacy india – best india pharmacy

mexican mail order pharmacies: medicine in mexico pharmacies – medicine in mexico pharmacies

http://foruspharma.com/# mexico drug stores pharmacies

best mail order pharmacy canada reliable canadian pharmacy reviews best canadian online pharmacy

https://indiapharmast.com/# indian pharmacies safe

canadian pharmacy online ship to usa: canadian drugs pharmacy – canadian pharmacy uk delivery

canadian pharmacy checker: canadian online pharmacy – online canadian pharmacy reviews

http://doxycyclinedelivery.pro/# doxycycline online singapore

medicine amoxicillin 500 amoxicillin 500 tablet amoxicillin online pharmacy

https://clomiddelivery.pro/# can i buy generic clomid

cheap doxycycline online uk: purchase doxycycline online uk – doxycycline acne

http://doxycyclinedelivery.pro/# doxycycline for sale online

https://ciprodelivery.pro/# buy cipro

ciprofloxacin mail online buy cipro cheap ciprofloxacin generic price

https://amoxildelivery.pro/# where can you buy amoxicillin over the counter

buy amoxicillin from canada: amoxicillin 500mg capsule buy online – amoxicillin 500mg without prescription

https://paxloviddelivery.pro/# paxlovid pill

http://paxloviddelivery.pro/# п»їpaxlovid

http://ciprodelivery.pro/# buy cipro cheap

doxycycline cost canada can you buy doxycycline over the counter in india can you buy doxycycline over the counter in mexico

cost of doxycycline prescription 100mg: doxycycline 75 mg capsules – doxycycline 150 mg tablets

https://doxycyclinedelivery.pro/# doxycycline medicine

New Model Fresh Design Surface Home Appliance Flue Type Gas Water Heater

Bathroom Flue Type Gas Hot Water Heater

tokina.co.kr

China Wholesale Fans Music Concert Customization Logo Summer Women T Shirt Taylor Printed Woman T-Shirt

China Customization Logo New Fashion Cute Cat Round Neck Women Tshirt Multi Color Casual Oversized Women T-Shirt

Fiber Optic Cable Raw Materials

Aluminum Copolymer Coated Tape

LPG Natural Flue Type 10L Cold Steel Gas Water Heater

China Factory Wholesale Summer New Fashion Simple Casual Soft All-Match Hot Basic Crop Tops Women Tshirt

Hot Selling Customzed Image Tankless Instant Gas Water Heater for Shower Bathing

China Factory Short Sleeve Crop Tops Sexy T-Shirts Women Y2k High Quality Butterfly New Design Women Tshirt

Eaa Al Eaa Lamination Tape

Aluminium Master Alloys

China Customization New Short Sleeve T-Shirt Women Solid Simple Casual Soft All-Match Women Tshirt

Portable Perfect Tankless LPG Natural Instant Flue Type 10 Liter Gas Geyser

Cable Compounds Material

https://amoxildelivery.pro/# amoxicillin 500mg prescription

http://paxloviddelivery.pro/# Paxlovid buy online

cheapest doxycycline tablets online doxycycline drug doxycycline

http://doxycyclinedelivery.pro/# can you buy doxycycline over the counter in mexico

paxlovid for sale: paxlovid india – paxlovid price

https://doxycyclinedelivery.pro/# where can you buy doxycycline online

Custom Logo Option OEM/ODM Versatile Custom Color Colors Ideal for Golf Cricket Casual Wear Polos Tshirts

techbase.co.kr

Ribbed Biker Shorts

Wholesale Ladies Custom Logo Exercise T-Shirt Women Fitness T Shirts Plain Custom Printing Soft Comfort Running Cropped Tops

Casual Blue Polo Shirt with Grey Collar Detail for Women and Men Perfect Golf Tennis Apparel

Die Clamps For Quick Die Change

Seamless Ribbed Tank Top

Workout Tops For Women

Navy Blue Cotton Polo Tshirt For Men Classic Comfort Fit Golf Casual Shirt Men's Solid Navy Blue Polo Tshirt Knitted Cotton

Quick Die Change

Classic Plain Blue Hoodie for Men Comfortable Cotton Zip-Up Jacket Versatile Casual Streetwear Essential

Sports Bra Sets

Mold Cart System

Workout Tops For Women

Stamping Press Quick Die Change

Injection Molding Mold Change Procedure

http://ciprodelivery.pro/# cipro online no prescription in the usa

amoxicillin pills 500 mg amoxicillin capsule 500mg price buy amoxicillin 500mg online

dtmx.pl

Custom Polo Crop Top Women Knitted Chic White Ribbed V-Neck Polo Crop Top For Trendsetting Women

Wholesale Lidong Custom Logo Embroidered Plain Sporty Royal Blue Polo T-Shirt With Trim Detail For Athletic Wear

Black Quilted Chain Handle Medium Backpack

Rhinestone-Studded Blush Pink Quilted Backpack

Copper Foil Mylar

Matte Black Rectangle Outline Hair Claws

Fiberoptic

Furry Koala Purple Bow Backpack

Sophisticated Black Short Sleeve Polo Shirt for Women's Casual and Work Environments Versatile black women's polo shirt

Kids Daisy Hair Claw Clip

Copper Foil Mylar

Short Sleeve Woman Polo Shirts High Quality Custom Polyester Polo Shirts Modern Print Zippered Polo For Stylish Women

Cable Compounds Material

Classic Navy Blue Polo Shirt For Women Perfect Fit Everyday Comfort Women's Wear Short Sleeve Shirt Golf Polo T-Shirts

Cable Filling Compound

https://paxloviddelivery.pro/# paxlovid pharmacy

generic amoxicillin cost: amoxicillin 500mg price canada – can you buy amoxicillin over the counter in canada

http://amoxildelivery.pro/# amoxicillin pharmacy price

https://doxycyclinedelivery.pro/# can i buy doxycycline over the counter

buy cipro online ciprofloxacin 500mg buy online buy ciprofloxacin

https://clomiddelivery.pro/# where to buy clomid without a prescription

paxlovid covid: paxlovid generic – Paxlovid buy online

https://ciprodelivery.pro/# buy cipro online

https://ciprodelivery.pro/# cipro ciprofloxacin

https://paxloviddelivery.pro/# paxlovid cost without insurance

buy paxlovid online paxlovid for sale paxlovid cost without insurance

where buy generic clomid without a prescription: can i order cheap clomid prices – buying generic clomid without insurance

https://paxloviddelivery.pro/# paxlovid generic

http://www.mck-web.co.jp

Ear Cuff

Bling Heart Pink Furry Diaries

Holographic Butterflies Mini Journal Notebook

This product is no longer available.

Frog Hoodie Strawberry Milk Bear Lock Diary

Pearl Drop Earrings

Brown Bear Fur Diary

Transfer Custom Tshirt Printing Customizable Long-Sleeve White T-Shirt for Women – Cotton Tee

Luxurious Oversized T-Shirt with High-End Design Premium Cotton

Oversize Blank Solid Colors T-shirt Custom Logo Grey T-shirt for Women Soft Cotton Versatile Fashion

Customizable Pink T-shirt for Women with Space to Show Your Logo Casual Fit

Earrings By Bulk

White Gold Ring Holds

Panda Cookie Lock Diary

Rose Gold Plated Jewelry Wholesale

http://clomiddelivery.pro/# can i purchase clomid without rx

https://clomiddelivery.pro/# how to buy generic clomid without rx

doxycycline 100mg cap order doxycycline capsules online doxycycline 110 mg

Hand Pocket Mirror with Lights

Brightness Adjustment Makeup Mirror with 9 PCS Bulbs

Commercial Nugget Ice Maker

Hot Sale Fashion Custom Printing Logo Luxury Plus Size Women's Hoodies Long Sleeve Sweater Sportswear Hoodie

Hollywood Style Brightness Adjustable Vanity Mirror

Customized High Quality Unique Design Hoodies Oversized Cut Crop Top Urban Sustainable Hoodie For Woman

Ice Maker Machine Industrial

http://www.thinkplus.tv

Shaved Ice Maker Machine

Ice Maker For Ice Bath

Custom Women Cropped Winter Hoodies Clothes Jumper Breathable Oversized Streetwear Jacket Coat Hoodies

Wholesale Custom Print Women Sweatshirt Soft Casual Loose Long Hoodies Women Pastel Colors Sport Hoodie

Magnifying Mirror with Lights

Travel Portable LED Mirror

Ice Makers

Customized Autumn Winter Grain Fleece Hooded Zipper Hoodies Women Oversize Sweet Cardigan Jacket Top Hoodies

China Factory Good Price Summer New Design Oversize Round Neck Digital Printing Pattern Fashion Women T Shirt

High Quality 100% Cotton Oversized Heavy Tshirt Custom Printing Heavyweight T shirt Plain Blank women t-shirt

Elegant White T-Shirt with Rhinestone Embellishments Chic Women's Top

Copper Elbow

Stainless Steel Seamless Pipe

Custom women's Sexy Crewneck loose Crop Top Tee Fashion with pocket Ladies short Sleeve Organic Cotton T-shirts For Women

Car Interior Wipes

Summer Casual Cotton Spandex Round Neck Baby Tee Hot Sale Slim Fit Sleeve Contrast Binding Ringer Cropped T Shirt Women

Car Clean Wipes

Seamless Pipe

lacalab.tempsite.ws

Biodegradable Floor Wet Wipes

Elbow Reducer Pvc

Upvc Brass Elbow

Glass Cleaner Wipes For Car

Disposable Floor Wipes

Elegant Long-Sleeve Pleated Grey T-Shirt Flowy Women's Top Versatile Casual to Work Wear

Cotton Crop Top Blank T shirt for Women Custom Logo for Your Brand XS to 3XL Slim Cropped Ladies Tee

Braided Copper Ground Wire

Tinned Copper Flexible Braids

Car Garage Tools

tinosolar.be

Croptop T Shirt Women's Loose Fit Cropped Wholesale Plus Size Women's T-shirt Women Light Weight T-shirts

Unisex Classic Black Hoodie Cotton Oversized Men's Sweatshirts Streetwear Essentials Drop Shoulder Plain Blank Hoodies

Copper Braided Cable

Car Tools

Flat Copper Braid

Auto Repair Tools

Cool Dry Basic Running Shirts Short Sleeve Round Neck Gym Yoga T-shirt Women Sportswear Fitness & Yoga Wear Nylon Cotton

Automotive Tool Set

Automotive Wrench Set

Bare Braided Copper Wire

30kva Generator

Customizable Logo White Hoodie – Unisex Fit With Front Pouch Pocket For Branding Hoodie Unisex White Sweatshirt

Men's basic crew-neck T-shirt comfortable to wear all day soft textiles with color Men's multi-colored T-shirt

15um OPP Metallized Film

OEM Mens Hoodie Sweatshirt Long Sleeve custom Printed Logo Tri-Color Hooded Sweatshirts Bundle – Classic Comfort Fit

30kva Generator

PET Laser Film

3000 Kw Generator

12um PET Metallized Film

Blue OPP Metalized Film2

Low Noise Generators

Custom Logo Women Ladies polo t shirts Classic Blue Soft Cotton Polo T-Shirt For Women Everyday Comfort

Diesel Generator Fuel Tanks

http://www.profkom.timacad.ru

Bold text printed men's long sleeve T-shirt Red accent street top can be customized logo

Black PET Metalized Film

Solar Storage Cost

Halogen Heater

Casual Solid Color Men's Tee with Curved Hem and Minimalist Design Breathable Cotton Fabric

Cost Of Home Solar Battery Storage

Solar Plus Storage Systems

5kw Storage Battery

Soft Cotton Comfort Fit

Crop tops Tee Shirt Sexy Thin Blank Shirt Chic Contrast Sleeve Ribbed T-Shirt for Women Casual Fitted Top Soft Cotton Blend

2 Mwh Battery

High Quality Customizable 100% Cotton Men's T-Shirt – Personalized Comfort Fit Apparel Screen-printable Tee

Quartz Heater

Heater

Basic Grey Tee for Women

Ceramic Heater

http://www.kerteszkedes.hu

Carbon Heater

Air Source Industry High Heat Water Heat Pump

Women's Fashion Cotton Tshirt Oversized Fit Blue Blank Streetwear Top for Custom Graphics High-Quality Ropa Mujer

Air Source Industrial High Temperature Heat Pump

20mm Porcelain Tiles

Customizable Logo Women's T-Shirt in Soft Pink Wholesale Casual Cotton Tee for Brand Promotion Comfort Fit

Assorted Color Cotton Tshirts for Streetwear Comfort Fit Blank Tees for Custom Graphics High-Quality Fabric Tops

http://www.ketamata.com

Sustainable V-Neck Tshirts Women Soft Breathable Eco-Friendly Fashion Wholesale Packs in Assorted Color Comfort Fit Tees

600x600mm Semi Polished Tiles

Energy-Saving Heat Pump of Air Source Industrial

Customizable Plain White T-Shirt 100% Cotton Women's Basic Round-Neck Tee Perfect For Printing Bulk Orders Welcome

12×24 Ceramic Tile

Industrial and Commercial Central Air Conditioners

Industry High-Efficiency Heat Pump Of Air Source

Grey Wood Ceramic Tile

Large Marble Wall Tiles

Golf Bags

Zinc Alloy Die Casting

Aluminum Precision Machining

Backpack For School

Metal CNC Machining

Urban Fashion Men's Hoodie with Chenille Letter Patches Zip-Up Streetwear Jacket for Casual Style Enthusiasts

Soccer & volleyball & basketball bag

Neutral Tone Hoodie With Complimentary Logo Print – Comfortable Cotton Blend Promotion Wear Quality Fabric Hoodie

Backpack Women

Awayluggage

Custom Logo Polo Tshirt For Men Comfort Cotton Knit Casual Golf Shirt Casual Knit Golf Shirt For Business Custom Color

Metal Precision Machining

Steel CNC Machining

provino.com.kz

Casual Artistic Men's T-Shirt with Unique Handprint Motif Soft Cotton Daily Fashion Top

Women's Short Sleeve Polo Shirt Assorted Colors Custom Logo Polyester Fabric for Golf Tennis Active Wear.